Seismic Zoning Map of India

Mumbai Seismic Zone Map

-

Wednesday, Dec 26, 2018

-

New Delhi 12 °C

Mumbai’s eastern suburbs most vulnerable to earthquakes, finds IIT-Bombay study

BMC-IIT study: A fault line at Panvel, 18 km to Mumbai’s east, is still active and this poses the threat to areas nearby

mumbai Updated: Apr 13, 2017 15:11 IST

IIT Bombay and civic agency’s study will help disaster management planning in Mumbai.(HT File Photo)

The risk of an earthquake striking is greater in

Mumbai’s eastern localities such as Shivaji Nagar, Govandi, Ghatkopar,

Bhandup, Powai, Vikhroli, Vidyavihar and Mulund. This is because a fault

line or fracture in the earth’s crust, which ups the chances of an

earthquake, runs from Panvel, 18 km to the city’s east, all the way

north to Koparkhairne and Bhiwandi.

These areas were identified after a study by a team from the Indian Institute of Technology-Bombay (IIT-B) showed that the fault line in Panvel is still active. As part of the study, the IIT-B team of two professors and two students measured the potential impact of an earthquake measuring 6.5 on the Richter scale on the city.

They found that Mumbai’s east, which is closer to Panvel, is more likely to be affected than the west and the island city.

“As the Panvel fault is still very prominent, its effect on the city cannot be ruled out. For an effective disaster management plan for the city, detailed information is key,” said Ravi Sinha, professor of civil engineering at IIT-B, who was part of the study.

The study also found that in 1618, close to 20,000 people lost their lives after an earthquake struck Mumbai, which at the time had a population of just 2 lakh.

Sinha said the longer the gap between two earthquakes, the higher will be the impact.

The study spanning two years was commissioned by the Brihanmumbai Municipal Corporation, which spent Rs23 lakh on the first-of-its-kind initiative so as to put in place a disaster management plan for these areas.

The BMC has divided the city into 7,700 grids of 250 sqm each. These grids have been overlaid on a Mumbai map that has details of hospitals, open plots, schools and shelters in every locality.

This will help the disaster management department during rescue operations (see box).

“We are working to modernise the entire disaster response system so that we can improve our response time and the quality of response when an emergency hits,” civic chief Ajoy Mehta told HT.

The department is also creating a detailed response plan in which it will list the number of beds in every hospital, the facilities available at police stations, fire stations and government offices, among others, to ensure minimum damage and loss of life during an earthquake.

These areas were identified after a study by a team from the Indian Institute of Technology-Bombay (IIT-B) showed that the fault line in Panvel is still active. As part of the study, the IIT-B team of two professors and two students measured the potential impact of an earthquake measuring 6.5 on the Richter scale on the city.

They found that Mumbai’s east, which is closer to Panvel, is more likely to be affected than the west and the island city.

“As the Panvel fault is still very prominent, its effect on the city cannot be ruled out. For an effective disaster management plan for the city, detailed information is key,” said Ravi Sinha, professor of civil engineering at IIT-B, who was part of the study.

The study also found that in 1618, close to 20,000 people lost their lives after an earthquake struck Mumbai, which at the time had a population of just 2 lakh.

Sinha said the longer the gap between two earthquakes, the higher will be the impact.

The study spanning two years was commissioned by the Brihanmumbai Municipal Corporation, which spent Rs23 lakh on the first-of-its-kind initiative so as to put in place a disaster management plan for these areas.

The BMC has divided the city into 7,700 grids of 250 sqm each. These grids have been overlaid on a Mumbai map that has details of hospitals, open plots, schools and shelters in every locality.

This will help the disaster management department during rescue operations (see box).

“We are working to modernise the entire disaster response system so that we can improve our response time and the quality of response when an emergency hits,” civic chief Ajoy Mehta told HT.

The department is also creating a detailed response plan in which it will list the number of beds in every hospital, the facilities available at police stations, fire stations and government offices, among others, to ensure minimum damage and loss of life during an earthquake.

'City falls in moderate seismic zone' | Mumbai News - Times of India

https://timesofindia.indiatimes.com/city/mumbai/City-falls...seismic-zone/.../1257119.cm...

'City falls in moderate seismic zone' | Mumbai News - Times of India

Oct 9, 2005 - MUMBAI: While areas in the Himalayan belt are more likely to experience major earthquakes as they lie in seismic zone 5, the country's financial capital lies in the moderate seismic zone 3 which can experience quakes up to 6.5 on the Richter scale.

1524 A.D. - Off the coast of Dabhol, Maharashtra.

A large tsunami (15) caused considerable alarm to the Portuguese fleet who were assembled off the coast of Dabhol (15), Maharashtra.

1594 A.D. - Matheran area, Maharashtra.

19.10 N, 73.20 E (1)

Maximum observed intensity IV (1). This region lies to the east of Mumbai and to the south-east of Kalyan. It is the earliest reported earthquake from this region.

26 May 1618 -

Mumbai area, Maharashtra.

18.90 N, 72.90 E (1)

Maximum observed intensity IX (9). This is the most damaging earthquake known to date in or near the Mumbai area. 2,000 fatalities are blamed on this event. The exact location and magnitude of this earthquake are still unclear.

18.90 N, 72.90 E (1)

Maximum observed intensity IX (9). This is the most damaging earthquake known to date in or near the Mumbai area. 2,000 fatalities are blamed on this event. The exact location and magnitude of this earthquake are still unclear.

1678 A.D. -

Matheran area, Maharashtra.

19.10 N, 73.20 E (1)

Maximum observed intensity VI (1). This region lies to the east of Mumbai and to the south-east of Kalyan.

09 December 1751 - Vangani-Matheran area, Maharashtra.

19.10 N, 73.20 E (1)

Maximum observed intensity VI (1). This region lies to the east of Mumbai and to the south-east of Kalyan.

05 January 1752 - Badlapur-Neral area, Maharashtra.

19.10 N, 73.30 E (8)

Maximum observed intensity V (8). This region lies to the east of Mumbai and to the south-east of Kalyan.

05 February 1752 - Lohagarh-Lonavala area, Maharashtra.

18.70 N, 73.40 E (8)

Maximum observed intensity V (8). This region lies to the west of Pune.

31 October 1757 - Valha-Jejuri area, Maharashtra.

18.20 N, 74.20 E (8)

Maximum observed intensity V (8). This region lies to the south-east of Pune.

19.10 N, 73.20 E (1)

Maximum observed intensity VI (1). This region lies to the east of Mumbai and to the south-east of Kalyan.

09 December 1751 - Vangani-Matheran area, Maharashtra.

19.10 N, 73.20 E (1)

Maximum observed intensity VI (1). This region lies to the east of Mumbai and to the south-east of Kalyan.

05 January 1752 - Badlapur-Neral area, Maharashtra.

19.10 N, 73.30 E (8)

Maximum observed intensity V (8). This region lies to the east of Mumbai and to the south-east of Kalyan.

05 February 1752 - Lohagarh-Lonavala area, Maharashtra.

18.70 N, 73.40 E (8)

Maximum observed intensity V (8). This region lies to the west of Pune.

31 October 1757 - Valha-Jejuri area, Maharashtra.

18.20 N, 74.20 E (8)

Maximum observed intensity V (8). This region lies to the south-east of Pune.

1760 - Pune area,

Maharashtra.

18.50 N, 73.90 E (8)

Maximum observed intensity IV (8).

17 August 1764 - Mahabaleshwar-Panchgani area, Maharashtra.

17.90 N, 73.70 E

Maximum observed intensity VII (8). Felt in western Maharashtra, at Nashik, Phaltan, Wai, Karad and Hukeri. This region lies to the south-west of Pune.

29 May 1792 - Amli-Revadanda area, Maharashtra.

18.50 N, 73.00 E (8)

Maximum observed intensity V (8). This region lies to the south of Alibag and north of Murud.

18.50 N, 73.90 E (8)

Maximum observed intensity IV (8).

17 August 1764 - Mahabaleshwar-Panchgani area, Maharashtra.

17.90 N, 73.70 E

Maximum observed intensity VII (8). Felt in western Maharashtra, at Nashik, Phaltan, Wai, Karad and Hukeri. This region lies to the south-west of Pune.

29 May 1792 - Amli-Revadanda area, Maharashtra.

18.50 N, 73.00 E (8)

Maximum observed intensity V (8). This region lies to the south of Alibag and north of Murud.

20 March 1826 -

Talgaon-Kudal area, Maharashtra.

16.10 N, 73.70 E (8)

Maximum observed intensity VI (8). This region lies to the east of Malvan. This earthquake is also known as the Moze Morwade earthquake.

04 December 1832 - Ajgaon-Terekhol area, Maharashtra.

15.800 N, 73.700 E (8)

Maximum observed intensity VI (8). This earthquake is the largest event known near the state of Goa. No moderate or major earthquakes have been recorded in Goa.

26 December 1849 - Bombay Harbour, Maharashtra.

18.90 N, 72.90 E (8)

Maximum observed intensity IV 8). This region to the east of Colaba, Mumbai.

16.10 N, 73.70 E (8)

Maximum observed intensity VI (8). This region lies to the east of Malvan. This earthquake is also known as the Moze Morwade earthquake.

04 December 1832 - Ajgaon-Terekhol area, Maharashtra.

15.800 N, 73.700 E (8)

Maximum observed intensity VI (8). This earthquake is the largest event known near the state of Goa. No moderate or major earthquakes have been recorded in Goa.

26 December 1849 - Bombay Harbour, Maharashtra.

18.90 N, 72.90 E (8)

Maximum observed intensity IV 8). This region to the east of Colaba, Mumbai.

November 1854 -

Bombay Harbour, Maharashtra.

18.90 N, 72.90 E (8)

Maximum observed intensity IV (8). This region to the east of Colaba, Mumbai.

18.90 N, 72.90 E (8)

Maximum observed intensity IV (8). This region to the east of Colaba, Mumbai.

18 December 1854

- Bombay Harbour, Maharashtra.

18.90 N, 72.90 E (8)

Maximum observed intensity IV (8). This region to the east of Colaba, Mumbai.

18.90 N, 72.90 E (8)

Maximum observed intensity IV (8). This region to the east of Colaba, Mumbai.

25 December 1856

- Parsipada-Kasa Khurd area, Maharashtra.

20.00 N, 73.00 E (1)

Maximum observed intensity VII (1). This region lies to the east of Tarapur and to the west of Nashik.

20.00 N, 73.00 E (1)

Maximum observed intensity VII (1). This region lies to the east of Tarapur and to the west of Nashik.

18 November 1863

- Nagalwadi-Julwania area, Madhya Pradesh.

21.80 N, 75.30 E

Maximum observed intensity VI (8). This region lies along the border of Maharashtra in the Khandwa area of Madhya Pradesh.

21.80 N, 75.30 E

Maximum observed intensity VI (8). This region lies along the border of Maharashtra in the Khandwa area of Madhya Pradesh.

04 July 1869 -

Lasalgaon-Vinchur area, Maharashtra.

20.20 N, 74.20 E (1)

Maximum observed intensity V (1). This region lies to the north-east of Nashik.

20.20 N, 74.20 E (1)

Maximum observed intensity V (1). This region lies to the north-east of Nashik.

22 November 1872

- Mahadeopur-Sironcha area, Andhra Pradesh.

18.86 N, 80.10 E (9)

Maximum observed intensity VI (9). This area straddles the state border between Andhra Pradesh and Maharashtra.

20 July 1935 - Parsipada-Kasa Khurd area, Maharashtra, Ms 5.0 (1).

20.00 N, 73.00 E (1)

This region lies to the east of Tarapur and to the west of Nashik.

16 September 1935 - Vashi area, Maharashtra, M? 3.0 (8).

19.10 N, 73.00 E (8)

Maximum observed intensity III 8).

18.86 N, 80.10 E (9)

Maximum observed intensity VI (9). This area straddles the state border between Andhra Pradesh and Maharashtra.

20 July 1935 - Parsipada-Kasa Khurd area, Maharashtra, Ms 5.0 (1).

20.00 N, 73.00 E (1)

This region lies to the east of Tarapur and to the west of Nashik.

16 September 1935 - Vashi area, Maharashtra, M? 3.0 (8).

19.10 N, 73.00 E (8)

Maximum observed intensity III 8).

14 March 1938 -

Bhusawal-Sawda area, Maharashtra, Mw 6.3 (11).

21.13 N, 75.83 E, D=040.0 kms, OT=00:48:38 UTC (2)

Maximum observed intensity VII (2). This earthquake was felt over a wide region, including at Agra in the north and Mumbai in the west. Deep-seated event (11), with a focal depth (11) of 40 kilometres.

21.13 N, 75.83 E, D=040.0 kms, OT=00:48:38 UTC (2)

Maximum observed intensity VII (2). This earthquake was felt over a wide region, including at Agra in the north and Mumbai in the west. Deep-seated event (11), with a focal depth (11) of 40 kilometres.

27 November 1945

- Off the Makran coast, Pakistan, Mw 8.0 (14)

24.500 N, 63.000 E, D=025.0 kms, OT=21:56 UTC (14)

At least 2000 people killed in southern Pakistan and neighbouring Iran. Tsunamis with heights of 12 meters struck the Makran coast. Damage also occurred at Ormara. 15 people were killed by the tsunami in Mumbai.

08 April 1951 - Off the Konkan Coast, M? 6.0 (9)

18.500 N, 70.800 E, OT=20:53:08 UTC (9)

Centred in the Arabian Sea, 218 kilometres east-south-east of Mumbai, this was the largest earthquake in this part of the Arabian Sea in recent history. It was felt at Mumbai, Pune and Surat.

25 August 1957 - Lalburra-Tikari area, Madhya Pradesh, Ms 5.5 (2).

22.000 N, 80.000 E, OT=21:04:50 UTC (2)

The district of Balaghat in Madhya Pradesh and Bhandara in Maharashtra were affected. 25 fatalities are reported for this event. The epicentre of this earthquake was north of the town of Waraseoni in Madhya Pradesh and the town of Gondia in Maharashtra.

13 December 1957

- Koyna area, Maharashtra, M? 5.4 (9).24.500 N, 63.000 E, D=025.0 kms, OT=21:56 UTC (14)

At least 2000 people killed in southern Pakistan and neighbouring Iran. Tsunamis with heights of 12 meters struck the Makran coast. Damage also occurred at Ormara. 15 people were killed by the tsunami in Mumbai.

08 April 1951 - Off the Konkan Coast, M? 6.0 (9)

18.500 N, 70.800 E, OT=20:53:08 UTC (9)

Centred in the Arabian Sea, 218 kilometres east-south-east of Mumbai, this was the largest earthquake in this part of the Arabian Sea in recent history. It was felt at Mumbai, Pune and Surat.

25 August 1957 - Lalburra-Tikari area, Madhya Pradesh, Ms 5.5 (2).

22.000 N, 80.000 E, OT=21:04:50 UTC (2)

The district of Balaghat in Madhya Pradesh and Bhandara in Maharashtra were affected. 25 fatalities are reported for this event. The epicentre of this earthquake was north of the town of Waraseoni in Madhya Pradesh and the town of Gondia in Maharashtra.

17.300 N, 73.700 E, OT=03:37:12 UTC (9)

- No Comment -

04 June 1965 - Koyna area, Maharashtra, M? 5.4 (9).

17.000 N, 73.400 E, OT=03:37:12 UTC (9)

- No Comment -

25 April 1967 - Mahad-Goregaon area, Maharashtra, M? 5.6 (9).

18.260 N, 73.300 E, D=051.0 kms, OT=03:53:19 UTC (5)

This event was located on the Konkan coast, to the south-west of Pune.

13 September 1967 - Koyna area, Maharashtra, M? 6.0 (5, 9).

17.600 N, 74.000 E, D=004.0 kms, OT=06:23:32 UTC (5, 9)

Felt strongly in western Maharashtra. Some damage reported (7) in the Koyna region.

13 September 1967 - Koyna area, Maharashtra, Ms 5.5 (2).

17.400 N, 73.700 E, D=004.0 kms, OT=06:48:25 UTC (2)

Felt strongly in western Maharashtra. Some damage reported (7) in the Koyna region.

10 December 1967 - Koyna area, Maharashtra, Mw 6.5 (2).

17.450 N, 73.850 E, D=027.0 kms, OT=06:48:25 UTC (2)

200 people were killed and many villages in the Koynanagar area were severely affected. The Koyna Dam suffered some structural damage and leaks were observed in the face of the dam. Tremors were felt strongly in many towns and cities in western Maharashtra, including, Mumbai and Pune. Also felt in Goa and other parts of western and southern India.

26 September 1970 - Wai area, Maharashtra, M? 5.5 (9).

18.000 N, 74.000 E, OT=16:36:44 UTC (9)

It is located roughly 60 kilometres to the south of Pune.

17 February 1974 - Arabian Sea, M? 5.0 (8).

17.500 N, 73.100 E (8)

This event was located off the Konkan coast, to the west of Guhagar near Ratnagiri.

02 September 1980 - Koyna area, Maharashtra, Mw 5.0 (13).

17.270 N, 73.760 E, D=033.0 kms, OT=16:39:14 UTC (2)

Strongest in a series of small to moderate earthquakes from this date to the end of September 1980.

20 September 1980 - Koyna area, Maharashtra, Ms 5.2 (2).

17.260 N, 73.640 E, D=019.0 kms, OT=10:45:30 UTC (2)

Second largest event in a series of small to moderate earthquakes from this date to the end of September 1980.

14 September 1983 - Bhatsa area, Maharashtra, Mb 4.3 (2).

19.640 N, 73.540 E, D=033.0 kms, OT=21:53:41 UTC (2)

This earthquake is believed to have been induced by the Bhatsa Dam .

I believe palghar earth quakes of 2018 also due to bhatsa dam

14 November 1984 - Koyna area, Maharashtra, Mb 4.5 (2).

17.280 N, 73.960 E, D=015.0 kms, OT=11:58:20 UTC (2)

Felt strongly in western Maharashtra and as far as Belgaum, Karnataka. 2 injuries were reported (10).

12 August 1991 - Arabian Sea, Ms 4.1 (10).

18.387 E, 71.15 E, D=033.0 kms, OT=16:41:06 UTC (10)

This earthquake was centred in the Arabian Sea, roughly 138 kilometres south-southwest of Colaba, Mumbai.

18 October 1992 - Nilanga-Killari area, Maharashtra, Mb 4.3 (2).

18.100 E, 76.730 E, D=025.0 kms, OT=17:33:02 UTC (2)

Felt strongly in Latur district and many people rushed outdoors in panic. Many buildings were damaged by the tremor, which was the largest event in a swarm that was felt in the area from August to October 1992.

24 August 1993 - Arabian Sea, Mb 4.9 (2).

20.700 E, 71.440 E, D=029.0 kms, OT=17:47:30 UTC (2)

This event was located in the Gulf of Khambat, to the west of Surat, Gujarat. This earthquake was felt widely in south-eastern Gujarat and parts of coastal Maharashtra. In Gujarat, people rushed out into the open at Ankleshwar, Bardoli, Bharuch and Bulsar. It was felt strongly (MM V) at Rajula. It was also felt (MM IV) at Amreli, Bhavnagar and Surat. In Maharashtra, it was felt (MM III) in Mumbai. Reports of tremors were received from Bandra, Chembur, Juhu, Kandivili and Prabhadevi. The shock was perceived over an area with a radius of 250 kilometres.

28 August 1993 - Koyna area, Maharashtra, Mb 4.8 (2).

17.240 N, 73.730 E, D=005.0 kms, OT=04:26:24 UTC (2)

Felt in western Maharashtra, including at Mumbai and Pune. 10 school students were injured in a stampede that broke out in their school in Ichalkaranji. Slight damage was reported for this tremor.

30 September 1993 - Killari area, Maharashtra, Mw 6.2 (10)

18.090 N, 76.470 E, OT=22:25:50 UTC (2)

Among the deadliest intraplate earthquakes on record. Close to 8,000 people were killed and thousands injured in the pre-dawn earthquake. Many villages in the epicentral area, around Killari were razed to the ground. 55 people were killed in the neighbouring state of Karnataka, in Gulbarga district. Strong tremors were experienced at Hyderabad, Pune and Mumbai and across much of Maharashtra, Karnataka, Andhra Pradesh and Goa. Tremors were felt as far as Chennai.

08 December 1993 - Chandoli area, Maharashtra, Mw 5.1 (13).

17.000 N, 73.650 E, D=032.0 kms, OT=01:42:17 UTC (2)

1 elderly woman died of a heart attack and 6 were injured in this early morning quake. It was felt very strongly all over western Maharashtra and Goa for close to 20 seconds. Moderate damage was reported in several villages in the epicentral area.

01 February 1994 - Koyna area, Maharashtra, Mb 5.0

17.228 N, 73.523 E, OT=09:30:55 UTC (10)

1 person hospitalised for shock in the Pimpri-Chinchwad area. Tremors were felt for close to 18 seconds in western Maharashta and in Goa and Karnataka.

14 December 1995 - Killari area, Maharashtra, ML 4.6 (4)

18.131 N, 76.543 E, D=010.0 kms, OT=04:09:32 UTC (4)

Felt in widely in the Marathwada area of Maharashtra. 10-12 wall collapses were reported from the Umarga area of Dharashiv (Osmanabad) district. Many houses in Ausa, Ganjankhed, Haregaon, Mangrul, Nandurga, Nimbala, Nilanga, Renapur, Sirsi Police Lines and Talni developed cracks.

31 May 1998 - Koparpada-Naude area, Maharashtra, ML 3.6

19.040 N, 73.110 E, OT=13:29 UTC (4)

This earthquake was the first instrumented event in this general area. Tremors were felt in Thane (MM IV-V) and at Dombivili, Kalyan, Kulgaon and Mumbra. Mild tremors (MM III-IV) were experienced in Mumbai at Borivali, Chembur, Dahisar, Juhu, Malad, Mira Road, Santa Cruz and Wadala as well as in south Mumbai.

12 March 2000 - Koyna are, Maharashtra, Mw 5.0

17.244 N, 73.707 E, D=05.0 kms, OT=18:03:52 UTC

A moderate earthquake struck the Koyna region in Maharashtra, India, on 12 March 2000 at 23:33 PM local time resulting in some damage to property in the Koyna-Warna region of Maharashtra. It had a magnitude of Mw=5.0 and was felt for close to 28-seconds in the states of Maharashtra, Karnataka and Goa.

19 June 2000 - Killari area, Maharashtra, ML 4.6 (4)

18.008 N, 76.532 E, OT=08:22 UTC (4)

Felt in Marathwada, Maharashtra. Also felt at Solapur in Maharashtra and Gulbarga in Karnataka.

05 September 2000 - Koyna area, Maharashtra, Mw 5.2

17.332 N, 73.790 E, D=010.0 kms, OT=00:32:43 UTC

A moderate earthquake struck the Koyna region in Maharashtra, India, on 5 September 2000 at 06:02 AM local time resulting in some damage to property in the districts of Kolhapur, Pune, Ratnagiri, Satara and Sangli in Maharashtra. It had a magnitude of Mw=5.2 and was felt for close to 47-seconds in the states of Maharashtra, Karnataka and Goa.

16 November 2001 - Airoli area, Navi Mumbai, Maharashtra, ML 2.9

19.155 N, 73.007 E, OT=20:08:39 UTC

A mild earthquake struck parts of Thane and Mumbai districts, on 16 November 2001 at 01:38 AM local time. It had a magnitude of ML=2.9 and was felt distinctly in parts of both districts.

27 March 2003 - Koyna area, Maharashtra, ML 4.1

17.379 N, 73.803 E, D=015.0 kms, OT=06:18:25 UTC

A light earthquake struck the Koyna-Warna region in Maharashtra, India, on 27 March 2003 at 11:48 AM local time causing minor damage to property in Patan taluka. The earthquake had a magnitude of ML=4.1 and was felt in parts of western Maharashtra. A milder foreshock at 10:36 AM resulted in one death at Sayyedwadi in Ratnagiri district.

27 July 2003 - Sindvani area, Maharashtra, ML 3.8

21.878 N, 74.341 E, D=020.0 kms, OT=04:35:33 UTC

A mild earthquake struck the border areas of the states of Maharashtra, Madhya Pradesh and Gujarat on 27 July 2003 at 10:05 AM local time. It caused some minor damage in the region and had a magnitude of ML=3.8.

17 May 2004 - Katraj-Dive Ghats, Pune, ML 3.2

18.365 N, 73.936 E, D=08.3 kms, OT=22:14:41 UTC

A mild earthquake was felt in the Pune metropolitan area in Maharashtra, on 17 May 2004 at 03:44 AM local time. The earthquake had a magnitude of ML=3.2 and was centred in the Dive-Katraj range between the Dive & Katraj Ghats to the south of the Pune urban area.

14 March 2005 - Koyna area, Maharashtra, ML 5.1

17.139 N, 73.687 E, D=25.0 kms, OT=15:13:45 UTC

A moderate earthquake struck western Maharashtra as well as adjoining areas of Goa and northern Karnataka on the afternoon of 14 March 2005 and lasted nearly 30-seconds. It had a magnitude of ML=5.1. It caused damage in the Chandoli-Koyna-Warna region and resulted in at least 46 minor injuries. Another tremor of Mb=4.3 tremor occurred the following day.

13 April 2005 - Marathwada, Maharashtra, ML 4.0

18.66 N, 76.60 E, OT=06:07:03 UTC

A light earthquake struck the Marathwada region in Maharashtra, India, on 13 April 2005 at 11:37 AM local time causing minor damage to property in the region.

14 June 2005 - Ambarnath region, Maharashtra, Mw 3.7

19.238 N, 73.201 E, D=2 kms, OT=12:16:12 UTC

A mild earthquake struck the Titvala region near Mumbai, Maharashtra, on 14 June 2005 at 17:46 PM local time. It had a magnitude of Mw=3.7 and was felt in many towns in the region as well as in suburban Mumbai.

30 August 2005 - Koyna area, Maharashtra, Mb 4.7

17.070 N, 73.770 E, D=10.0 kms, OT=08:53:20 UTC

A light earthquake struck the Koyna-Warna region in Maharashtra, India, on 30 August 2005 at 02:23 AM local time causing minor damage to property in Patan taluka. The earthquake had a magnitude of Mb=4.7 and was felt in parts of western Maharashtra, north Karnataka and Goa.

4 January 2006 - Marathwada region, Maharashtra, ML 3.5

18.222 N, 76.392 E, D=7.1 kms, OT=11:01:33 UTC

A mild earthquake struck the Marathwada region in Maharashtra, India, on 4 January 2006 at 16:31 PM local time. It had a magnitude of ML=3.5 and was felt strongly in some parts of the region.

17 April 2006 - Koyna area, Maharashtra, Mb 4.4

17.003 N, 73.797 E, D=35.0 kms, OT=16:40:02 UTC

A light earthquake struck the Koyna-Warna region in Maharashtra, India, on 17 April 2006 at 22:10 PM local time causing minor damage to property in Patan taluka. The earthquake had a magnitude of Mb=4.4 and was felt at many places in western Maharashtra, north Karnataka and Goa.

31 March 2007 - Nanded region, Maharashtra

An earthquake swarm accompanied by loud explosion-like reports began to be felt in the town of Nanded and the adjoining areas on 31 March 2007 local time. Minor damage and a few injuries were reported as a result of the tremors in Nanded.

6 June 2007 - Katraj-Khadakwasla region, Pune, Maharashtra, M2.6

OT=07:48 UTC

A mild earthquake was felt in the Pune metropolitan area in Maharashtra, on 6 June 2007 at 13:18 PM local time. The earthquake had a magnitude of M?=2.6 and was felt in parts of the Pune metropolitan area. Officials at the Meteorological Department also suggested the possibility that this might have been the result of underground tunneling work that is underway in the apparent epicentral region and not of seismic origin.

21 August 2007 - Warna-Koyna region, Maharashtra, ML 4.0

17.170 N, 73.770 E, D=5.0 kms, OT=19:15:51 UTC

A light earthquake occurred in Koyna-Warna (Chandoli) region of south-western Maharashtra on 21 August 2007 at 00:45 AM local time and caused minor damage in the epicentral region. The earthquake had a magnitude of ML=4.0 and was felt in several parts of the region including as far as the Pune region to the north.

6 September 2007 - Marathwada, Maharashtra, ML 4.1

18.057 N, 76.535 E, D=10.0 kms, OT=07:09:44 UTC

A light earthquake occurred in Marathwada region of south-central Maharashtra on 6 September 2007 at 12:39 PM local time and caused panic as well as minor damage in the epicentral region. The earthquake had a magnitude of ML=4.1 and was felt in parts of south-central Maharashtra and in north Karnataka.

30 July 2008 - Koyna region, Maharashtra Mb=4.3

17.324 N, 73.747 E, D=3.2 kms, OT=19:11:01 UTC

A light earthquake (M4.0-4.9 termed as light) occurred in the Koyna (Koynanagar-Helwak area) region of south-western Maharashtra on 30 July 2008 at 00:41 AM local time. The earthquake centred in the Gokul-Waghini area had a magnitude of Mb=4.3 causing some damage, minor injuries and was felt in several parts of the region including as far as Mumbai & Nashik.

16 September 2008 - Koyna region, Maharashtra Mb=4.9

17.289 N, 73.815 E, D=10 kms, OT=21:47:15 UTC

A light earthquake (M4.0-4.9 termed as light) occurred in the Koyna region of south-western Maharashtra on 17 September 2008 at 03:17 AM local time. The earthquake centred in the Koyna-Warna area had a magnitude of Mb=4.9 and caused widespread damage in the epicentral region and at least one death near Pune. The shock was felt for over 45-seconds in much of western Maharashtra, Goa and north Karnataka, even as far south as Bengaluru.

Maximum observed intensity IV (1). This region lies to the east of Mumbai and to the south-east of Kalyan. It is the earliest reported earthquake from this region.

Related news from geological survey of India on Western Deccan Volcanic region

Lava Channel of Khedrai Dam, Northeast of Nasik in Western Deccan ...

Lava Channel of Khedrai Dam, Northeast of Nasik in Western Deccan Volcanic ... lava tubes and extensive flow field during the 1991993 eruption of Mount Etna.

It

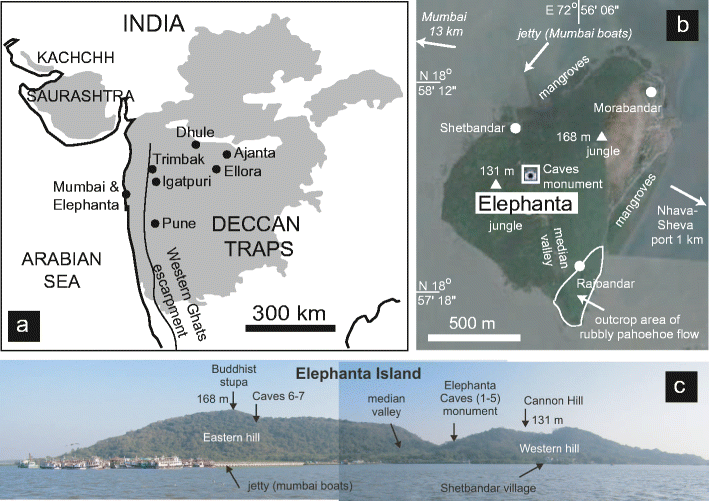

is interesting to note that most of the rock cut caves reported from

Maharashtra, in Deccan Volcanic Province are from pāhoehoe flows. ...

Lava caves are known to have served as homes and temporary shelters

throughout history and are significant archaeological sites.

Lava channel - Wikipedia

A lava channel is a stream of fluid lava contained within marginal zones of static (

The genesis of a lava cave in the Deccan ... - Scholar Commons

by NR Pawar - 2015 - Related articles

Deccan Volcanic Province; speleology; drained lobe; lava cave. Received 14 June ..... channel of Khedrai Dam, Northeast of Nasik in Western. Deccan volcanic ..Erosion helps discover lava cave at Somatne | Pune News - Times of ...

Dec 24, 2015 - TNN | Dec 24, 2015, 09:19 IST ... The cave, they say, was formed by draining of a segment of lava tube ... Ghoradeshwar already has Buddhist sculpted caves carved in lava ... paper titled 'The genesis of a lava cave in the Deccan Volcanic', ... Nikhil Pawar, a student of geography department at Nowrosjee

The volcanic geoheritage of the Elephanta Caves, Deccan Traps ...

India cut caves in Deccan basalt on the island of Elephanta, in the Mumbai ... and or the history of science, or can be used for research, teaching, squeeze-ups, ...

Deccan Traps - Wikipedia

Jump to History - History. The Deccan Traps began forming 66.25 million years ago, at the end of the Cretaceous period. The bulk of the volcanic eruption occurred at the Western Ghats some 66 million years ago. This series of eruptions may have lasted less than 30,000 years in total.

,Gilbert Hill-Andheri west:-http://oldphotosbombay.blogspot.in/2012/06/gilbert-hill-andheri-west.html

Gilbert Hill is a 60 m (197 ft) monolith column of black basalt rock in Andheri, inMumbai, India. The rock has a sheer vertical face and was formed when molten lava was squeezed out of the Earth's clefts during the Mesozoic Era about 65 million years ago. During that era, molten lava had spread around most of the Indian states of Maharashtra,Gujarat and Madhya Pradesh, covering an area of 50,000 square kilometres (19,000 sq mi). The volcanic eruptions were also responsible for the destruction of plant and animal life during that era.

volcanoes near Mumbai dinosaurshttp://www.livescience.com/25324-volcanoes-killed-dinosaurs.html